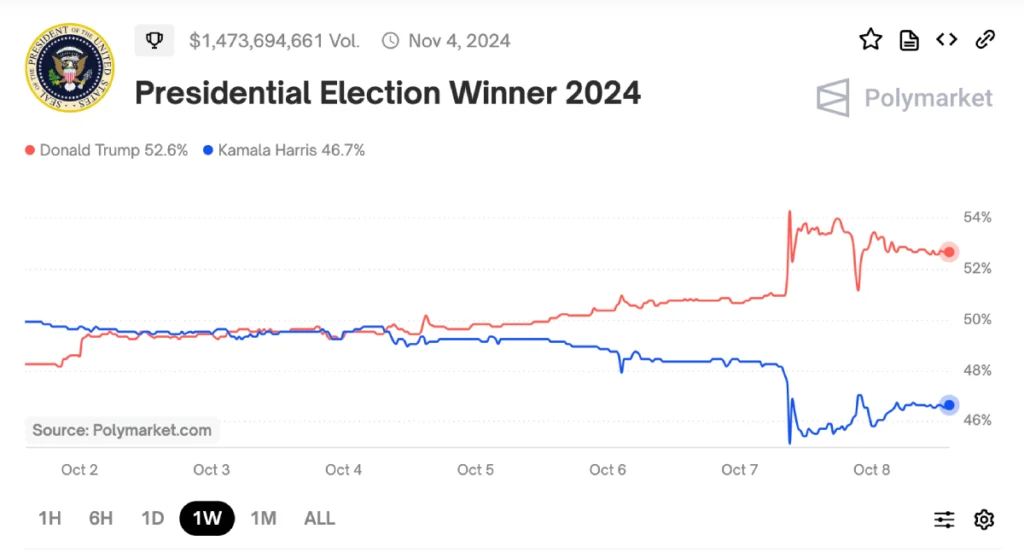

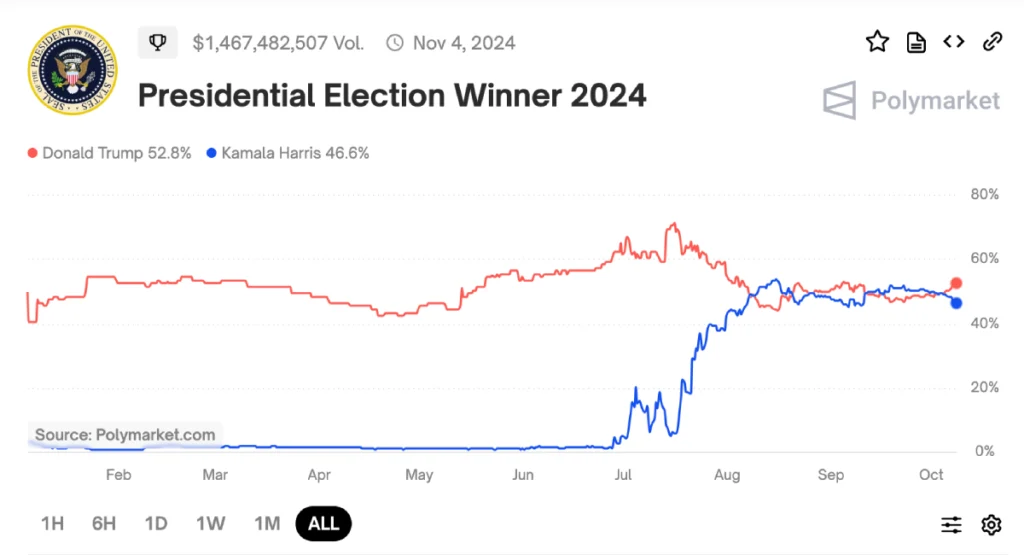

On the morning of Oct. 7, Donald Trump’s chances of victory surged from 51% to over 54% on Polymarket while Kamala Harris’ slid from 48% to nearly 45%. The rapid shift took place in about an hour and was spurred by large bets from an anonymous trader.

With no clear explanation, observers were left questioning the trader’s motive. Was it sharp money, an attempt at price manipulation, or just a deep-pocketed MAGA loyalist betting big on their team?

Polymarket not only had a larger spread between the presidential candidates than other platforms. It was also the only presidential market with abrupt price changes. Kalshi’s presidential market remained stable, and PredictIt’s Harris price fell three points over about a week.

It came down to the trading behavior of a mysterious Polymarket user: Fredi9999.

How Fredi moved the market

Up until the morning of Oct. 7, Fredi9999 had been steadily buying ‘Yes’ contracts on Trump’s popular vote victory for 26 cents each before the price spike. His last 26-cent purchase before he changed his trading pattern was at 10:25 ET. He had limit orders in place to automatically buy contracts at his desired price.

At 10:38 a.m. ET, Fredi9999 began buying ‘Yes’ contracts on Trump’s electoral victory at 52 cents each and continued to buy them up to 54 cents. He also bought ‘No’ contracts on Harris for 54 and 55 cents throughout the day. These dual price pressures pushed Trump’s victory price higher and pulled Harris’ victory price lower.

By 12 p.m. ET, Fredi9999 held about 7.3 million ‘Yes’ contracts on Trump’s electoral victory. In comparison, the next largest Trump ‘Yes’ holder has about 4.4 million shares. Harris’ largest ‘Yes’ holder only has 4.6 million shares. As of Oct. 9, Fredi9999 held 10.8 million ‘Yes’ contracts on Trump and was still buying them.

Could Fredi be Elon Musk?

On Oct. 6, Elon Musk made a surprise appearance at Trump’s rally in Butker, PA, touting the Republican candidate and proclaiming himself “dark MAGA”.

Musk’s behavior after the rally fuelled speculation that he is Fredi9999. A few hours after Fredi9999’s large purchases, Musk retweeted a screenshot of Polymarket’s presidential market highlighting the price spike.

Victory is not enough, it must be absolutely decisive victory https://t.co/Ixe4Hl5tTR

— Elon Musk (@elonmusk) October 7, 2024

A long-time political bettor and current industry commentator, Domer, acknowledged the strange trading pattern but was skeptical of a market manipulation attempt. Domer believed the sustained purchases suggested this whale account was a true believer and “If it’s not Musk, it is definitely someone very similar to Musk.”

Nate Silver also weighed in. He attributed Polymarket’s price spike to a whale account whose activity skewed Polymarket’s presidential price. Silver didn’t come out in favor of the Musk hypothesis, but this user must be someone with enough money to skew Polymarket’s largest market. An erratic billionaire with a history of trolling is a compelling suspect.

On Oct. 8, Polymarket’s presidential market had a 6.2-point spread between the candidates. PredictIt had a three-point spread, and Kalshi’s was only one point. There also weren’t major price movements in related markets, like the balance of power market or the popular vote winner market. The effect was isolated to the presidential winner market and still concentrated among one large trader.

The consequences of no position limits

Prediction market prices best represent a group’s forecast when no single opinion is allowed to dominate the market. Prices should move when most traders agree that new information changes the contracts’ value. Prediction markets eliminate error when enough traders of diverse opinions cancel out each other’s mistakes.

Regulated exchanges have position limits and trading hours to limit market manipulation and prevent large accounts from controlling prices. For example, Kalshi’s position limit in its presidential election market is $7 million per member and $100 million for “eligible contract participants.” In the smaller, more local Eric Adams resignation market, the position limit is only $25,000 per member with no carveouts for “eligible contract participants.”

Different traders may have different amounts of money to trade with, but factions are controlled and positions monitored. Eliminating trading and position limits maximizes profit potential, but also creates opportunities for outsized traders to control market prices.

Even Manifold, which offers a fictional free-to-play currency, has policies that regulate its free-to-play currency supply to ensure that its currency remains valuable and that its markets remain representative of the market’s opinion.

Polymarket lacks position or market limits. Consequently, Fredi9999 could buy Trump and Harris contracts in such large quantities that he caused a sudden price spike which wasn’t easily corrected.

What about tightening prices elsewhere?

From Oct. 2 to Oct. 7, prediction markets showed signs of a tightening race. Manifold’s price on Donald Trump’s victory increased by about 2 cents. PredictIt’s price on Kamala Harris’ victory dropped three cents. Kalshi’s presidential market launched on Oct. 4, and both candidates have been deadlocked in a two-cent spread for much of the market’s brief lifetime.

On Polymarket before its price spike, Harris and Trump went from being priced at just below 50 cents each to Trump leading Harris 51 cents to 48 cents. It wasn’t out of line with price movements across other prediction markets.

There are legitimate political reasons causing Harris to lose her edge in prediction markets. Tim Walz delivered an underwhelming debate performance on Oct. 1. Hurricane Helene hit Florida on Sept. 27, then devastated Tennessee and the Carolinas the next day. The ongoing devastation, challenges of delivering useful and timely federal aid, and Hurricane Milton’s impending landfall are all expected to pressure the incumbent administration.

On Oct. 8, a New York Times/Siena poll showed Harris not only ahead but also more widely perceived as the candidate promising change while Trump was more likely to represent a return to the status quo. However, that was a national poll, and both candidates were within the margin of error. The race is functionally tied, which is reflected in close prediction market prices.

On Trump’s side, his Oct. 6 rally in Butker, PA, where he was shot at on July 13, was in part a defiant return to a somber stage. But Elon Musk also spoke at this rally. Musk is an influential voice in the crypto space. His passion for Trump is a culmination of his longer political arc from occasional trolling to anti-establishment skepticism. Musk’s endorsements also could fuel enthusiasm among Trump supporters.

These factors show two candidates with passionate supporters and a race that remains a functional tie. That reality is reflected in polling, voter attitudes, and prediction market prices.

Polymarket’s skew in context

Polymarket’s price change episode is likely just the beginning of the conversation about individual traders’ impacts on market prices. Prediction market settlement terms create a lag between the event’s outcome and the market’s settlement. That gives many markets a second life. In Polymarket’s VP debate winner market, trading volume doubled between the end of the debate and the Monday after it.

Polymarket is basing its presidential winner market on the candidate Fox News, NBC, and the Associated Press call the race for. Given the delay in counting all ballots – and a clear customer preference for live betting – a lot of money will enter election markets on and after election day. Questions about the impact of whale accounts will likely come up again during the large influx of prediction market trades on and after Election Day.

In 2020, Trump supporters believed so passionately in Trump’s lies about how the election was stolen from him that they continued betting on Trump even after Biden had already won. Harris traders may be anticipating a similar pattern in 2024, which could be depressing her Polymarket price.

However, it shouldn’t be lost on traders and analysts how close the presidential race remains, even after Polymarket’s price spikes. The race is still functionally a 50/50 race that will depend on narrow election margins in about half a dozen states.

It also shouldn’t be lost on anyone that prediction markets do not decide elections. Prediction market performance is entangled with the fallibilities of a market’s traders. Polymarket shows how influential one large trader can be, but many smaller traders who are wrong in the same direction can create misleading prices, too.

Future of regulated prediction market platforms

Polymarket’s dramatic price movements may be a resounding argument for regulated election markets. The CFTC mandates trading and position limits to avoid misleading price spikes that can occur more easily on Polymarket. While the CFTC may not acknowledge it, Kalshi and ForecastEx are likely to be more accurate reflections of trader sentiment than Polymarket in the long run.

Kalshi and ForecastEx don’t have the trading volume that Polymarket does yet. Rutgers University statistician and prediction markets expert Harry Crane argued in an X post that “the fact Kalshi is new and has had at least one start/stop means traders may be slow to pile large amount of funds onto the site.”

It's much more likely that the price at Kalshi is off right now than Polymarket.

— Harry Crane (@HarryDCrane) October 9, 2024

The difference is relatively small regardless, but the fact Kalshi is new and has had at least one start/stop means traders may be slow to pile large amount of funds onto the site.

Other reasons:… https://t.co/zV8YwSgAnh

It may take a few weeks or another presidential election cycle to make the prices on Kalshi and Polymarket more reliably comparable.