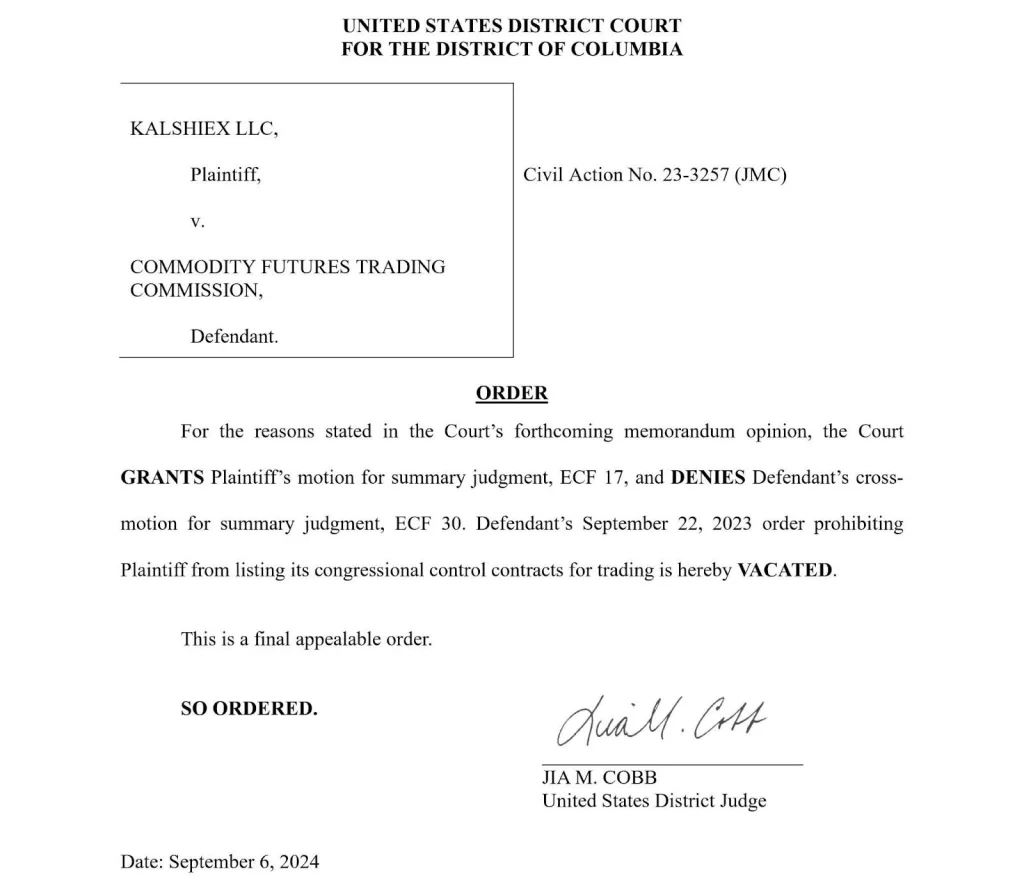

On Sept. 6, Kalshi won its lawsuit to offer congressional control markets on its platform. The election markets will allow traders to bet on which party will control Congress after the 2024 election.

In November 2023, Kalshi sued its regulator, the Commodity Futures and Trading Commission (CFTC) to allow election contracts. The CFTC had categorized election markets as “gambling” and made them illegal for Kalshi to offer.

Kalshi’s victory clears the way for the first regulated prediction markets in the U.S. covering the election.

Prediction Markets and Election Outcomes

Betting on elections has a long history. Bookmakers used to offer election odds in the United States. These odds functioned as early polls in the 18th and 19th centuries. However, Prohibition’s targeting of gambling and the success of scientific polling led election betting to fall out of favor in the United States.

That didn’t stop American financial firms from innovating new ways to hedge risk. Agricultural futures allowed farmers to use derivatives to hedge the risks of their harvests failing, deliveries ruining crops, or other systemic failures costing farmers their seasons’ yields. Over time, other commodities would be able to use futures the same way.

Kalshi took the next logical step. If companies could hedge against something happening to physical things, why couldn’t they also hedge against threatening events themselves? Kalshi’s event contracts also apply to political risk that individuals and companies could incur depending on which party controls Congress.

The CFTC initially rejected that reasoning. In a 23-page order rejecting Kalshi’s congressional control contracts, the CFTC considered the election markets “gambling” on elections. That made it a prohibited derivative in the spirit of Dodd-Frank, which a footnote within the order points out was meant to prevent gambling on derivatives.

Judge Cobb granted a motion for summary judgment favoring Kalshi. A detailed opinion is expected at a later date.