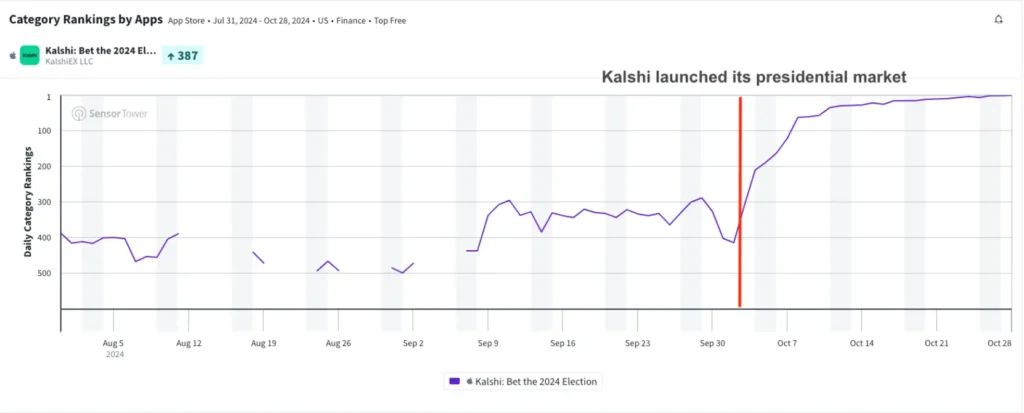

Kalshi has reached the No. 1 spot in the App Store’s finance category, surpassing Cash App and signaling a shift in interest toward event-driven financial platforms.

Co-founder Tarek Mansour announced the milestone on X and noted that the app could soon reach first place in the global App Store rankings, as it currently sits close to the top 10.

"Prediction markets now have many flavors - there's more competitors," says @Kalshi CEO on online betting. "We have way more contracts, and I'd like to think we have a much better product." pic.twitter.com/xzYVbx8ZUT

— Squawk Box (@SquawkCNBC) October 28, 2024

The lift of the U.S. Commodity Futures Trading Commission (CFTC) stay in early October allowed Kalshi to relaunch and expand its event derivatives markets. The spike in Kalshi’s downloads and engagement aligns closely with the launch of its highly anticipated 2024 U.S. presidential election market. This new market has attracted significant attention from users eager to engage in legal, event-driven trading, pushing the app’s downloads and user base to unprecedented levels.

To date, Kalshi has already accumulated over $85 million in trading volume in its presidential election winner market alone.

In an Oct. 28 interview with CNBC, Mansour shared that the average bet size on Kalshi is between $300 to $400, with larger bet sizes reaching into the millions. He contrasted Kalshi’s platform with that of competitor ForecastEX, noting, “We have way more contracts, much more liquidity, and I’d like to think we have a much better product.”

While Kalshi’s rise appears swift, it’s a product of years of groundwork. Dalton Caldwell, the managing director at Venture Capital firm Y Combinator, one of Kalshi’s early backers, released a short clip, highlighting the years of development behind the app’s “overnight” success, emphasizing the strategic moves and regulatory navigation that shaped the platform.

With its ascent to the top of the finance app rankings, Kalshi is now capturing mainstream attention, reflecting a potential shift in how Americans engage with financial markets. As of now, Kalshi stands out among its competitors for operating within a regulated framework, a factor that enhances its longevity and market reach.