Political futures markets were also popular in eighteenth-century Britain and Ireland, where they remain popular.

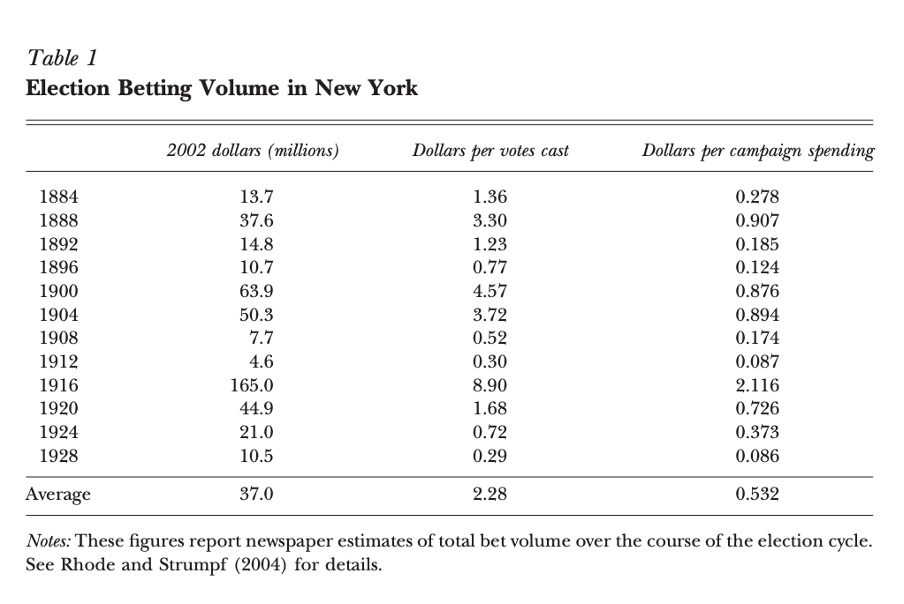

Back in the U.S., election betting remained common until the mid-twentieth century.

A sharp decline in political betting came in the early 1940s, after the Gallup poll successfully predicted the 1936 election.

These modern prediction markets tap into a long tradition that dates back centuries. While legal and ethical concerns continue to shape the industry, the demand for political betting and the insights these markets provide remains strong.

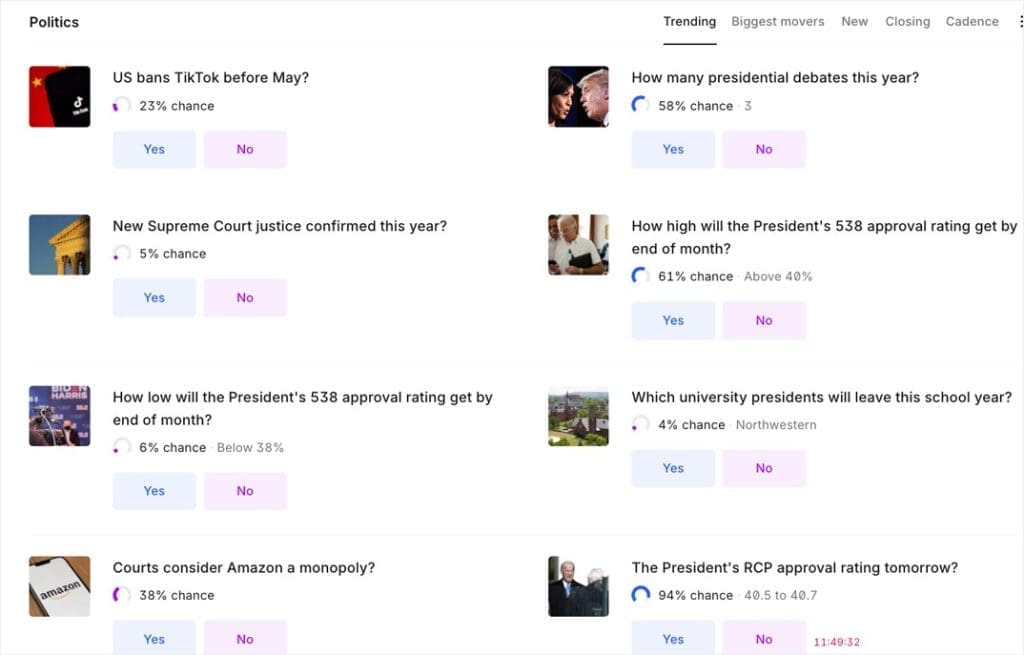

Outside of election markets, some of the most popular political betting markets include:

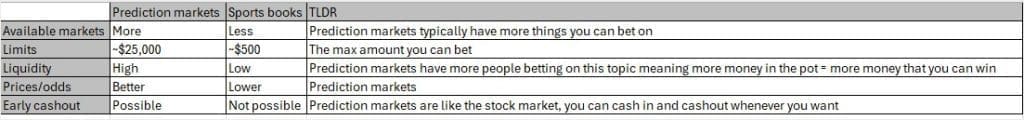

On that note, it’s also important to point out the differences between betting with a sportsbook and trading on a prediction market. In this article, I refer to both as a form of political betting but there are fundamental differences.

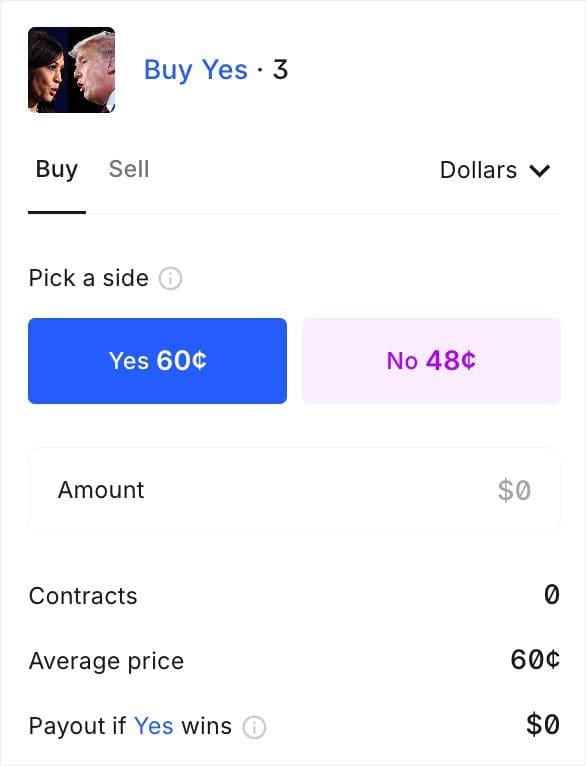

So when you’re betting on politics via prediction market platforms, you won’t see the type of odds associated with sports betting — i.e., American/moneyline, decimal, or fractional odds. Instead, you’ll encounter share prices between between $0.00-$1.00 or percentages between 0%-100%

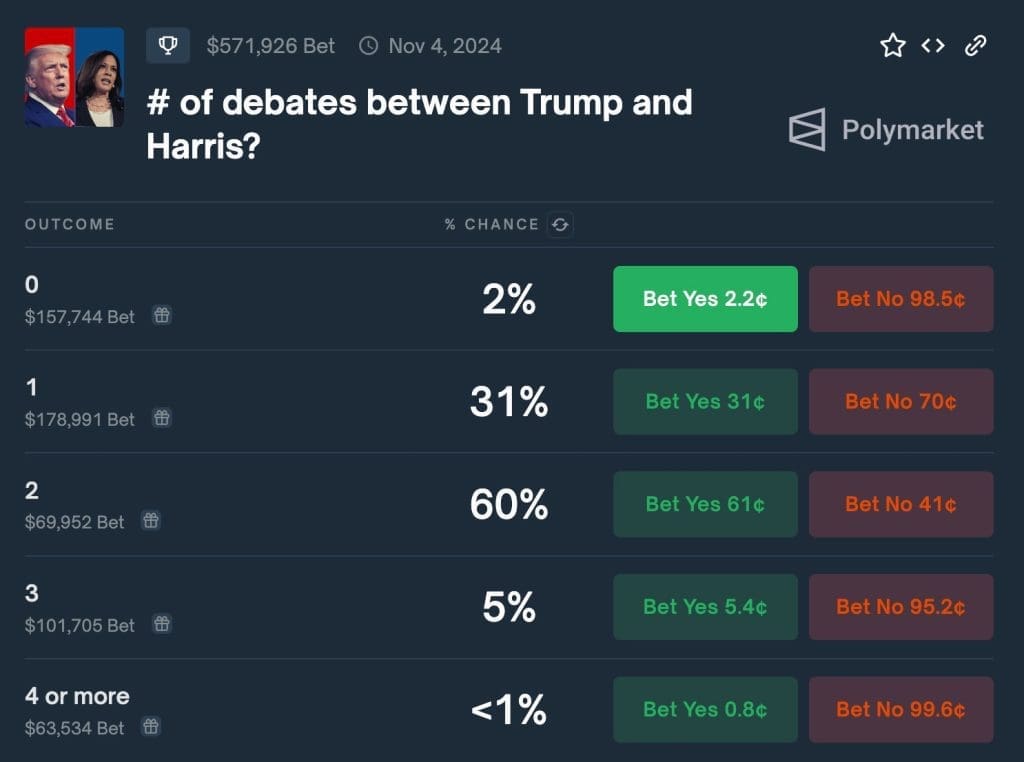

Below are examples of what these market prices look like on Kalshi, PredictIt and Polymarket.

For example, if an outcome is priced at .75c per share, this indicates a 75% chance of winning according to the market.

Whether you’re betting on politics casually or looking to get more serious, here are some tips to help find edges in political betting markets.

Start asking If, Then questions. If you want to win money betting on politics, then you need to be thinking a few steps ahead of the market. For example, think through the range of outcomes for one event and how they may impact others. If you’re thinking about things the right way, you will better anticipate market movements and position yourself to capitalize on shifts in public sentiment and new developments.

Stay informed and be adaptable. Political landscapes can change rapidly, especially in the lead-up to major events. Keep up with the latest news, debates, and political analyses to stay ahead of the curve. Flexibility is key.; Iif new information comes to light that changes the likelihood of an outcome, adjust your priors accordingly. In other words, be nimble and willing to cut your losses.

Look for undervalued opportunities. Sometimes the market undervalues certain outcomes, especially when the event date is still far away. Keep an eye out for situations where the market may be more confident than is warranted given current information. These are the opportunities where you can find value and buy low early, with the potential to sell later at a profit or win handsomely if the market resolves in your favor.

Scout biases, too. You can find value by spotting scenarios in which emotions and biases are higher than usual. There’s an assumption that PredictIt leans left and that Polymarket leans right. A significant portion of Polymarket’s customer base has some experience in the crypto industry. So you may want to ask yourself what are the demographics of a platform’s user base? How, if at all, does that impact some of the markets? Be mindful of situations where public perception might not align with the underlying data or trends.

Manage your bankroll wisely. Like any form of investing or betting, it’s important to manage your bankroll carefully. Don’t risk more than you can afford to lose, and consider diversifying your bets to spread out risk. Frugality can help you stay in the game longer and increase your chances of long- term success as you improve your skills.

Additionally, stay in tune with what other people are thinking but don’t turn your social media feeds and podcast libraries into an echo chamber. Venture out, follow, and listen to people with different perspectives, expertise, and experience.

SCOTUS (Supreme Court of the United States)