Kalshi Review

I’ve been trading on prediction markets for years, so I was ecstatic when I first heard about Kalshi, a CFTC-regulated prediction market that lets you trade on the outcome of real-world events (beyond politics).

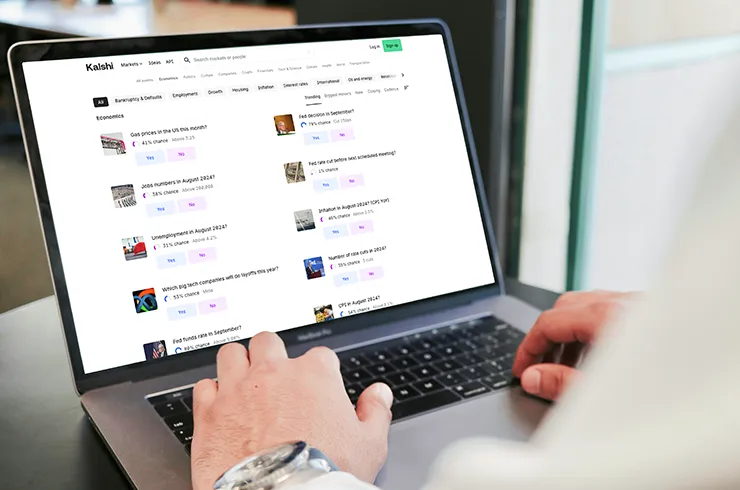

Prediction markets aren’t new, but a platform that was regulated in the U.S. and offered markets on everything from Federal Reserve interest rate hikes to Rotten Tomatoes scores felt like a significant evolution.

I was right. Over the last year I’ve traded nearly $2 million, and I can confirm Kalshi has become the go-to prediction market exchange in the U.S. for good reason: It’s safe, reliable, innovative, and relatively easy to use (though there is a learning curve!).

With that said, there’s a lot that can be improved and the platform isn’t perfect for everyone. In this Kalshi review, I’ll walk you through my hands-on experience with Kalshi covering everything from the sign-up process to the trading interface and fees. By the end, you’ll be able to decide if Kalshi is the right platform for you.

Kalshi Quick Facts

Sign-up Bonus | $25 deposit match |

Code | PREDICTION |

Founded | 2018 (Trading launched 2021) |

Eligible states | All 50 states in the U.S. + D.C. |

Regulation | CFTC-regulated Designated Contract Market (DCM) |

Minimum Deposit | $1 ($25 for sign-up offer) |

Trading Fees | Variable fee schedule dependent on prices, order types, and market types |

Withdrawal Methods | ACH, Wire Transfer, Debit Card |

Mobile App | iOS and Android available |

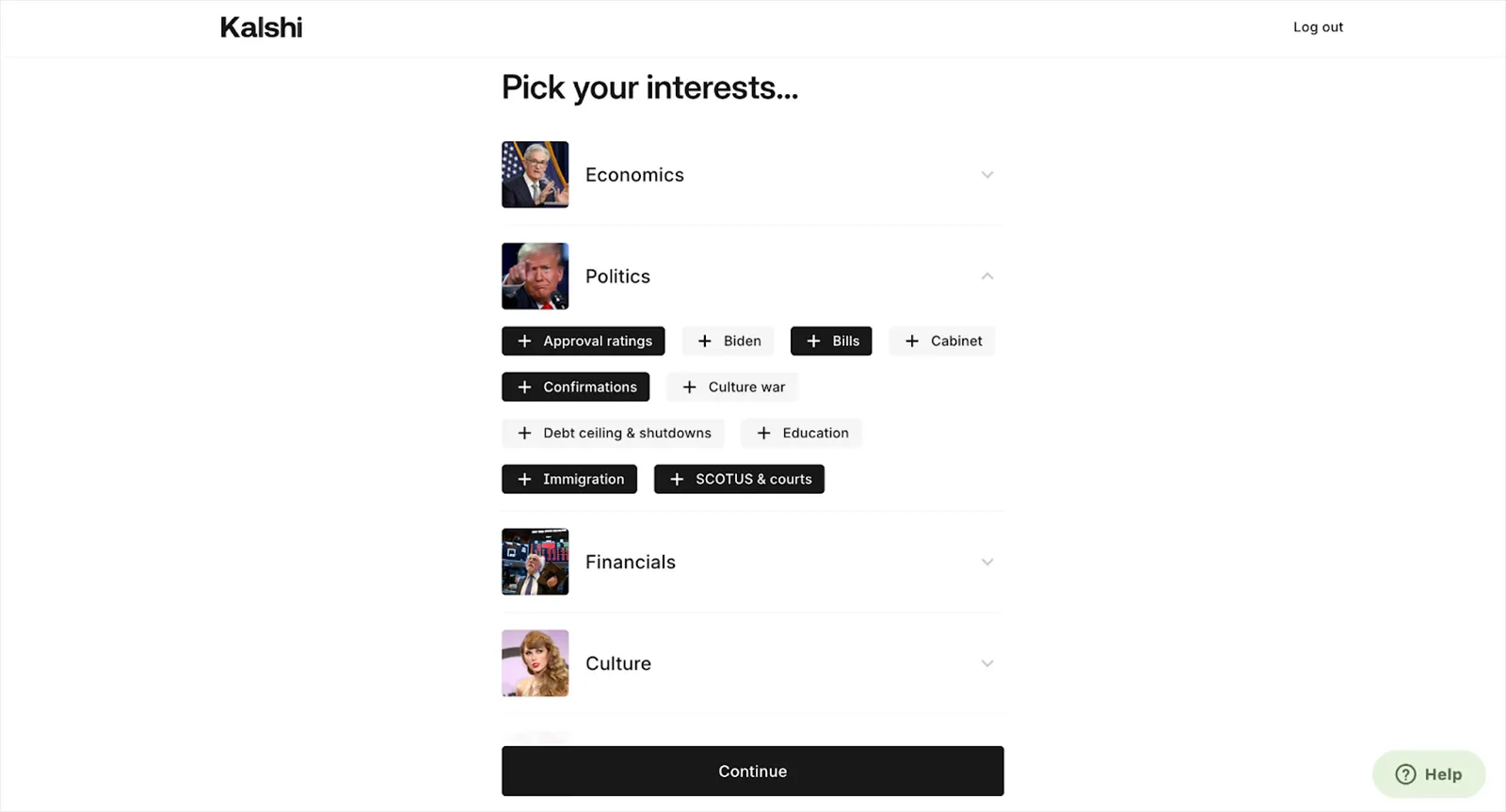

Markets Available | Politics, Economics, Weather, Sports, Entertainment, Science & Tech |

Account Types | Individual only (no joint or corporate accounts) |

Age Requirement | 18+ |

Overall Rating | 4.5/5 |

What is Kalshi?

Kalshi is a CFTC-regulated Designated Contract Market (DCM), an exchange that lists event contracts and allows users to make real-money predictions on future events for almost anything.

In fact, launched in 2021 by MIT graduates Tarek Mansour and Luana Lopes Lara, Kalshi is the Arabic word for everything.

Unlike traditional betting sites, Kalshi operates as a prediction market exchange, which means you’re trading contracts rather than betting against the house. Each contract asks a yes-or-no question about a future event—Will the Fed cut rates in December? Will Taylor Swift release an album this year?—and pays out $1 if correct, $0 if wrong.

The current market price (say, 73¢) reflects the collective probability traders assign to that outcome, and traders can buy and sell (trade) their position much like a stock before the event outcome is determined.

From a trader’s perspective, what matters most is that Kalshi offers exposure to events that simply aren’t available through traditional brokerages and sportsbooks. You can take positions on unemployment reports, congressional actions, or award show winners. For those who follow these areas closely, it’s a unique way to leverage and monetize expertise that previously had no financial outlet.

Is Kalshi safe?

This is likely your first question, and it was certainly mine when I first considered depositing funds. The bottom line: Yes, Kalshi is remarkably safe from a regulatory standpoint, and much safer than many offshore alternatives or even some crypto-based prediction markets.

Its biggest safety feature is its legal status. Being regulated by the CFTC means it has to abide by strict rules designed to protect traders and ensure market integrity.

Here’s what that means for you:

- Segregated Funds: Your money is held in a separate, segregated bank account, meaning Kalshi can’t use your funds for its operational expenses. If the company were to fail, your cash would be protected.

- Market Oversight: The CFTC monitors the markets and Kalshi has a surveillance team to sniff out manipulation. It’s not perfect, but there’s more safeguards on Kalshi than other platforms.

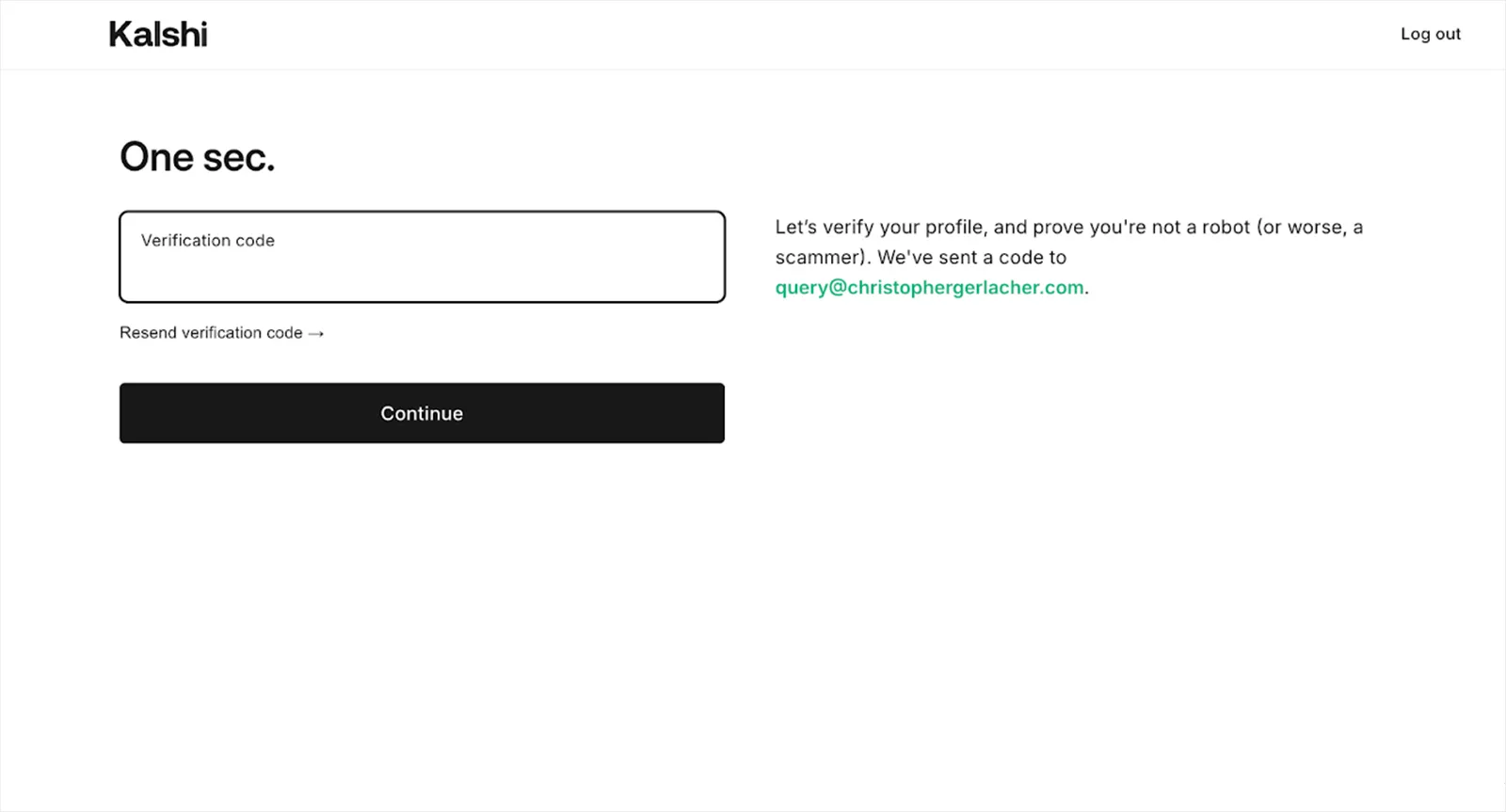

- Secure Platform: The platform itself uses standard security measures like two-factor authentication (2FA) to protect your account from unauthorized access.

From my experience, the platform is secure, and knowing there’s a federal agency providing oversight provides a level of confidence that is often missing in newer, alternative trading spaces.

That said, “safe” is relative. You can still lose 100% of your invested capital if your predictions are wrong. The regulatory structure protects against fraud and mismanagement, not against trading losses. And traders should still be cautious about the markets they trade on — if the question or rules are unclear, it’s safest to stay away.

Pros and cons of trading on Kalshi

Pros:

- Fully legal and regulated: No gray areas—this is a CFTC-regulated exchange operating within U.S. law

- Unique markets: Trade on events completely unavailable elsewhere (Fed decisions, legislation, weather, awards shows); Kalshi launches new markets every day.

- Trade on your knowledge: If you’re an expert in a specific field (like politics, economics, maybe a specific football conference, or even science), you can directly monetize that knowledge.

- No banning sharps: Since Kalshi isn’t the house, they won’t ban you if you’re sharp and winning too much.

- No max bet: For sports traders, you don’t have to worry about being limited. You can get hundreds of thousands of dollars down on a single trade.

- Transparent pricing: Real-time order books show exactly where liquidity sits

- Fast settlements: Contracts typically settle within 24 hours of the event resolving

Cons:

- High fees: Kalshi’s fees are high and growing, making their effective prices no better than what you’ll find on a sportsbook in many markets.

- Limited liquidity: Some markets have wide bid-ask spreads and thin order books.

- Limited order types: Lacks advanced order functionality (stop-losses, conditional orders, etc.)

- Learning curve: Understanding how the order book works how to effectively place trades takes some getting used to.

How to sign up and trade at Kalshi

How prediction markets work

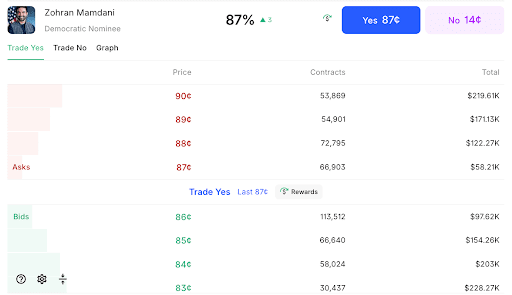

Contracts are priced between 1¢ and 99¢, and each contract always pays out exactly $1 if correct or $0 if incorrect. If a market is trading at 68¢, that means traders collectively believe there’s approximately a 68% chance the event occurs. If you believe the probability is higher than 68%, you buy; if lower, you sell.

Your profit or loss is straightforward:

- Buy ‘Yes’ at 63¢: If correct, you profit 37¢ per contract ($1 payout – $0.63 cost). If wrong, you lose 63¢.

- Buy ‘No’ at 37¢: If correct, you profit 63¢ per contract ($1 payout – $0.37 cost). If wrong, you lose 37¢.

Note: The back-the-napkin example above does not include trading fees, which vary across markets and prices.

The pricing dynamically adjusts as traders buy and sell, similar to stock prices. The key difference: there’s a defined endpoint where contracts settle at exactly $0 or $1 based on the real-world outcome.

You can find what people are trying to buy and sell, and how many contracts are available, at all times in the market’s order book.

What are some benefits of using Kalshi?

Kalshi is regulated by the CFTC, which brings important benefits that other prediction markets like Polymarket don’t have. CFTC regulations create guardrails that protect derivative exchanges from market manipulation and vet exchanges to ensure traders get their payouts.

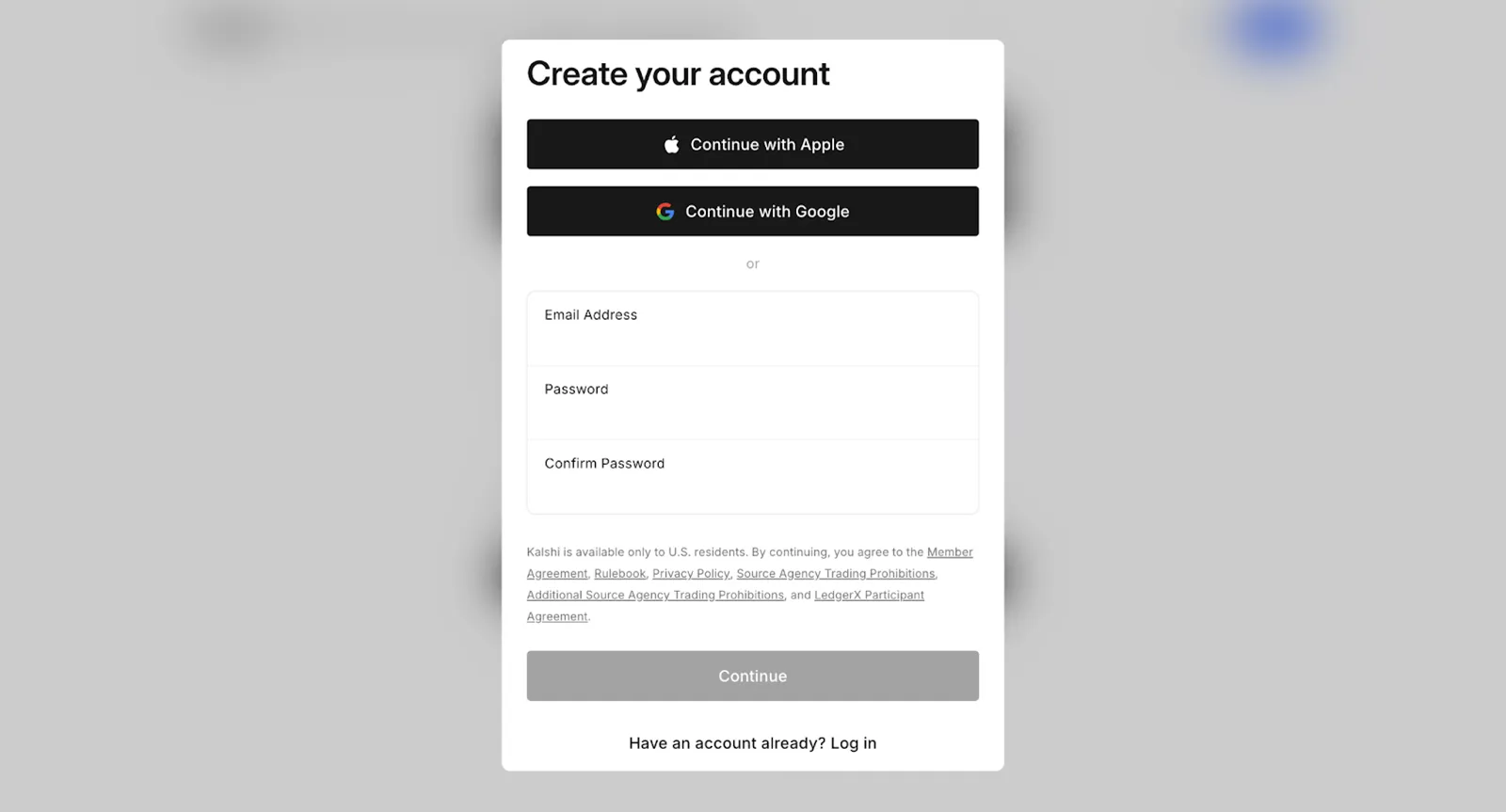

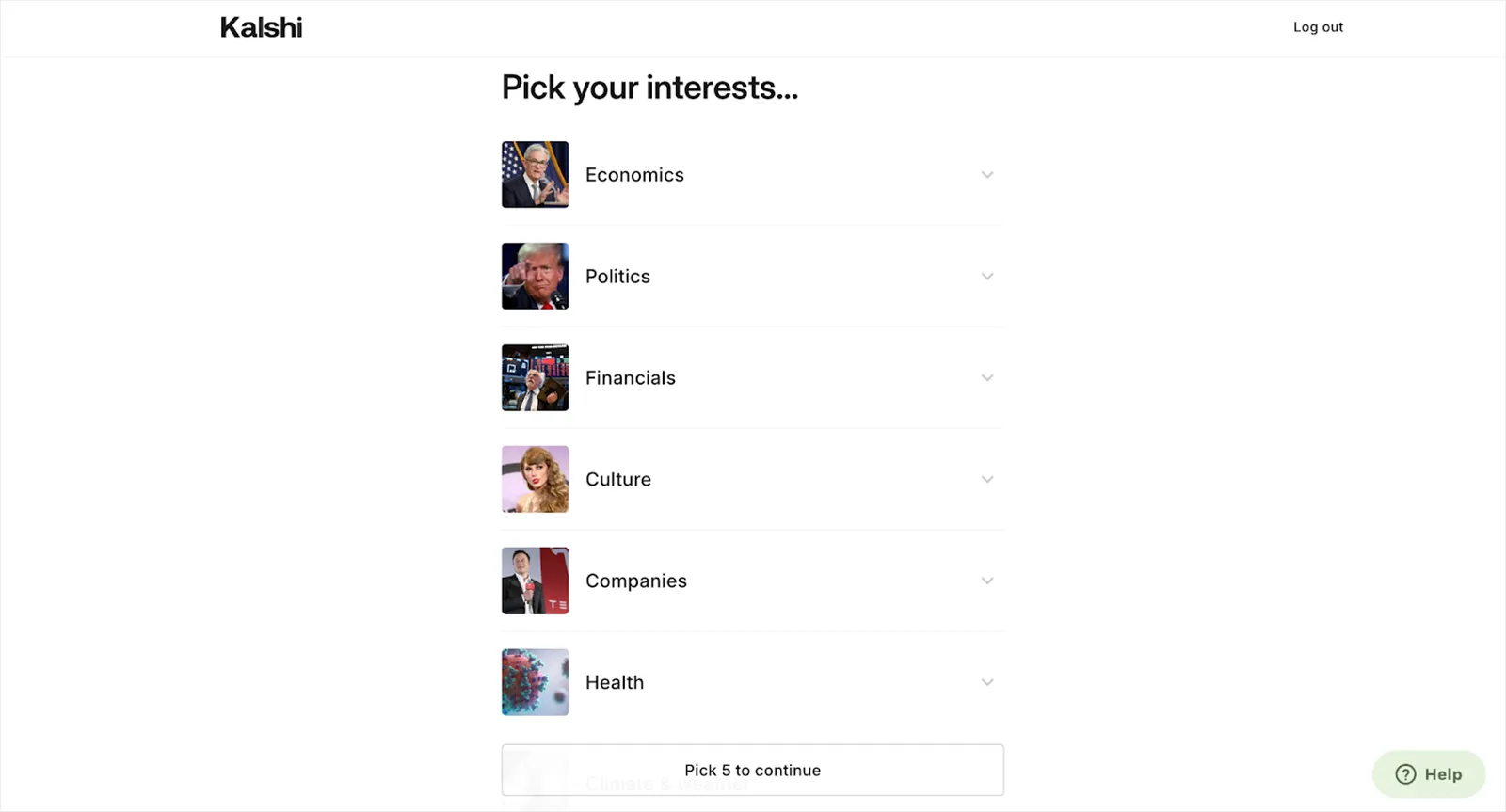

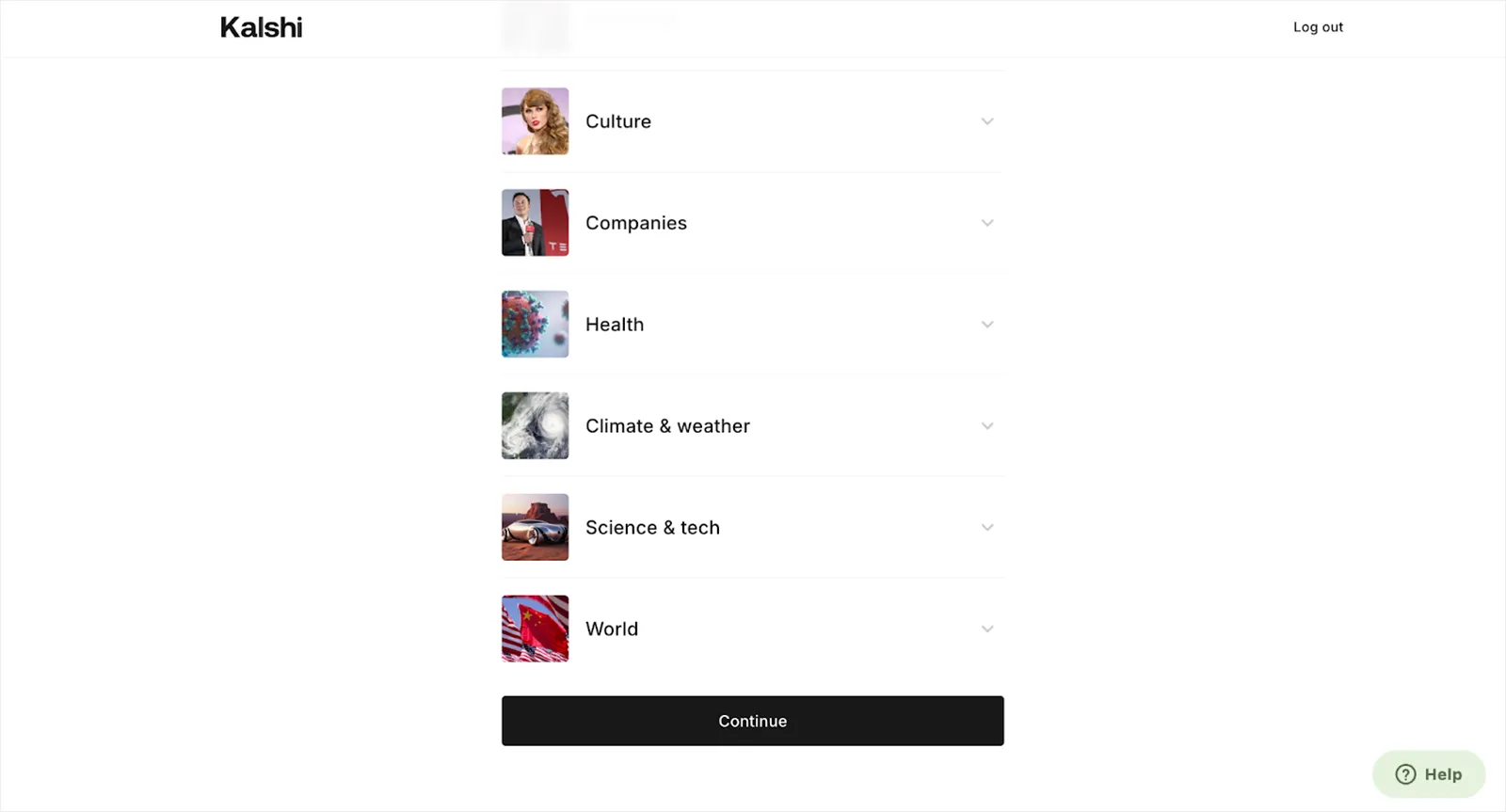

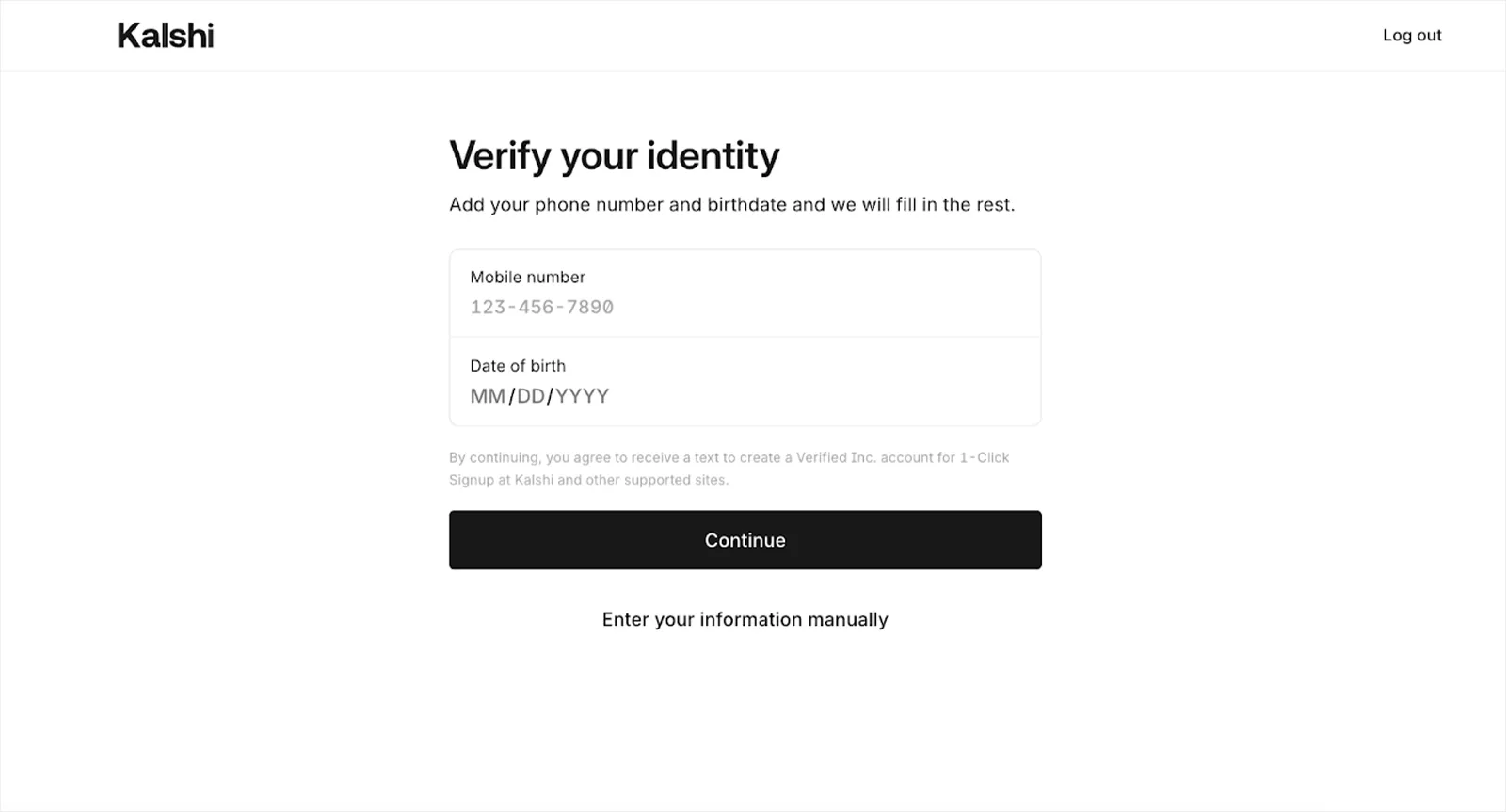

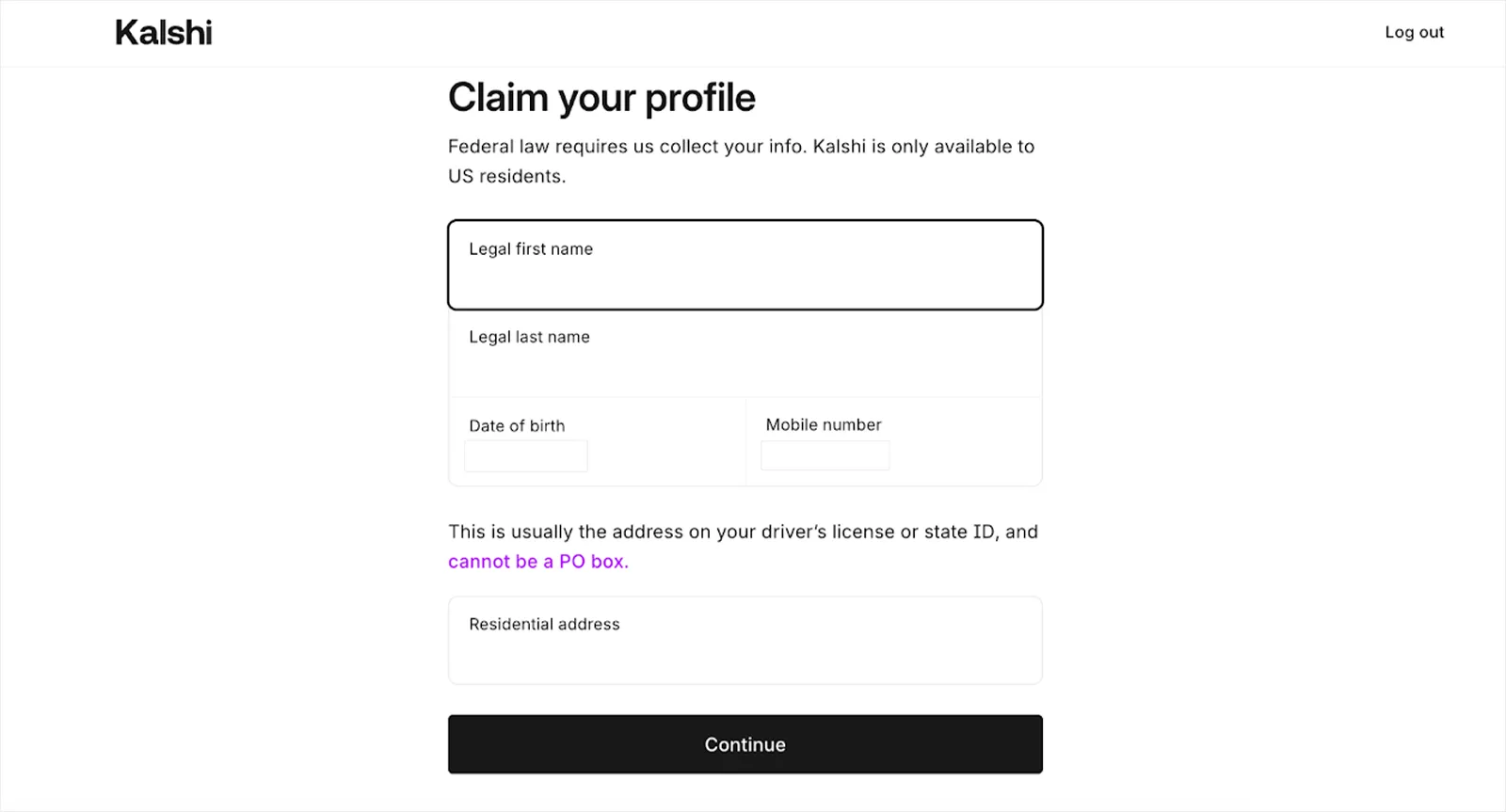

How to sign up and trade on Kalshi

Step 1

Step 2

Step 3

How to stay safe while trading on Kalshi

Don’t share your login credentials with anyone else, and don’t share accounts. If you have multiple people in your account, then you have multiple people who can make deposits from your bank or make trades you didn’t want to make.

You should also have a trading strategy. High or low-risk trading is fine, but have a plan so you can manage your losses and give yourself a chance at making some gains.

Kalshi fees

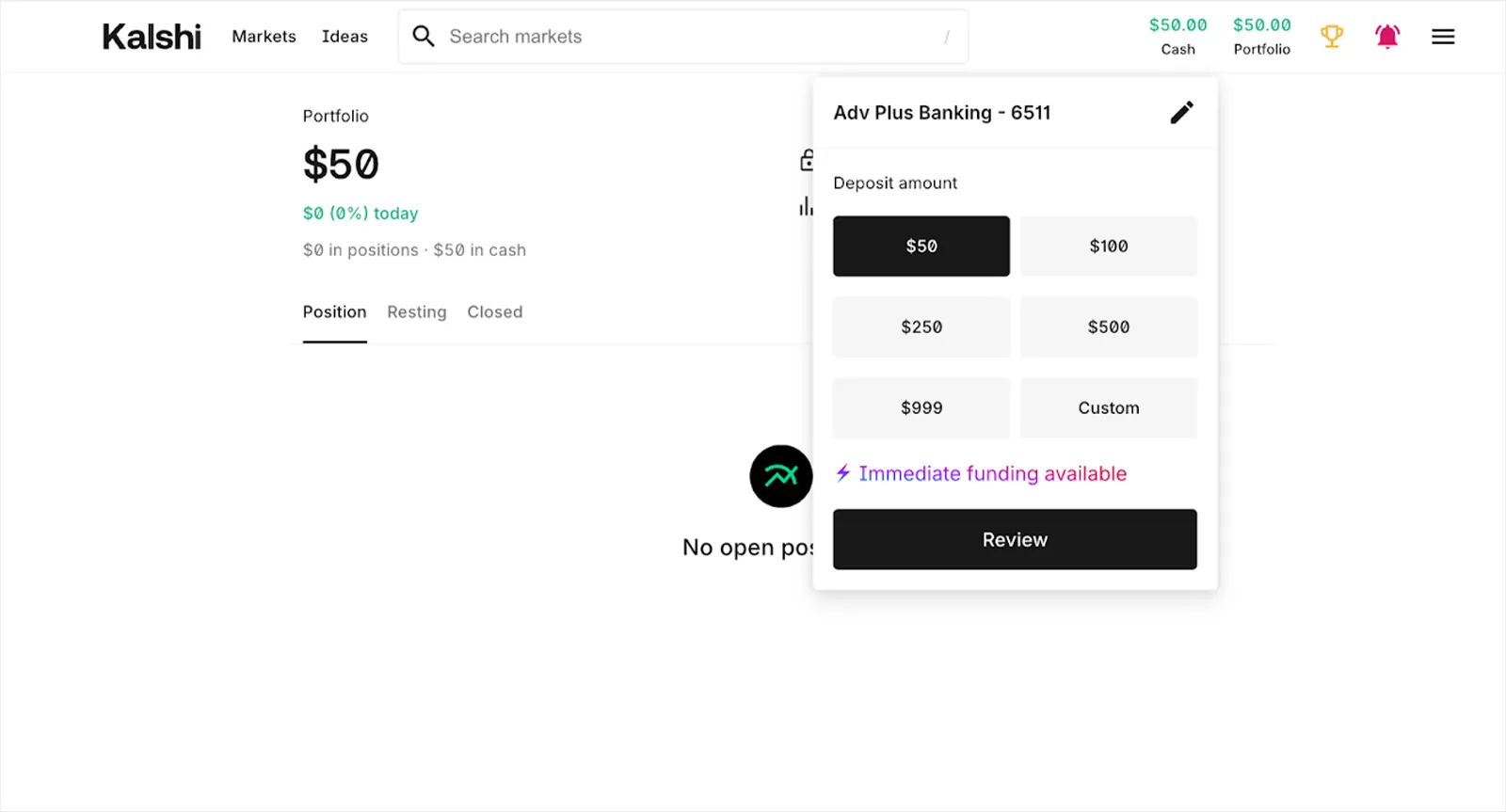

The withdrawal fee is a flat $2 fee on transfers from your Kalshi account to your bank.

Deposit and withdrawal options on Kalshi

This bank account link is one of the safest withdrawal and deposit options. Bank accounts help Kalshi adhere to know-your-customer and anti-money laundering requirements. The anti-terrorism legislation passed after 9/11 requires financial institutions to know who they’re sending money to. It’s also why customers are asked for personal information to verify their identities when they register.

Overall assessment: Should you trade on Kalshi?

While I’ve encountered some minor hiccups, I’ve enjoyed my experience trading on Kalshi. It’s been engaging and genuinely useful for expressing views on events I follow closely. I’ve profitably traded some niche markets, and I think the wide array of markets make Kalshi’s a suitable destination for anyone who wants to begin trading prediction markets.

At the same time, traders should know there is a learning curve, and if you aren’t willing to put in the time, you may be better off using traditional sportsbooks. Moreover, Kalshi’s fees add up fast and there are a lot of things Kalshi can do to improve the overall UX. Discoverability of markets is a major issue and liquidity is frustrating at times.

With that said, Kalshi occupies a unique niche. It’s not trying to replace your stock brokerage or crypto exchange. It’s offering something categorically different: legal, regulated exposure to real-world events. If that aligns with your interests and edge, it’s worth exploring with modest capital. Start small, understand how fees impact your bankroll, and see if the markets fit your trading style before committing significant funds.

The platform is improving, competition is emerging, and the prediction market space is rapidly evolving. Kalshi deserves credit for pioneering this regulatory pathway, even if execution still has room for improvement. For now, it’s the best legal option Americans have for trading real-world events.