A recently published dashboard on the blockchain analytics site Dune suggests that Polymarket forecasts events correctly about 90% of the time when measured one month before settlement.

The dashboard—created in early 2025 by data researcher Alex McCullough—compares Polymarket trading prices with each market’s eventual outcome. Under McCullough’s methodology, a forecast is deemed correct if:

- Events priced above 50¢ (50%) resolved to Yes

- Events priced below 50¢ (50%) resolved to No

McCullough’s findings are consistent with the historical accuracy of presidential betting markets. A 2004 study of presidential elections from 1884 to 1928 found that favorites won 11 out of 15 times. The underdog triumphed once, and three races were statistical toss‑ups.

While Polymarket’s top-line accuracy is interesting at face value, classifying every contract as right or wrong leaves out crucial probability information. A “Yes” contract priced at 99% that resolves to “No” is as inaccurate as a 51% forecast that misses, even though the first is a much larger miss.

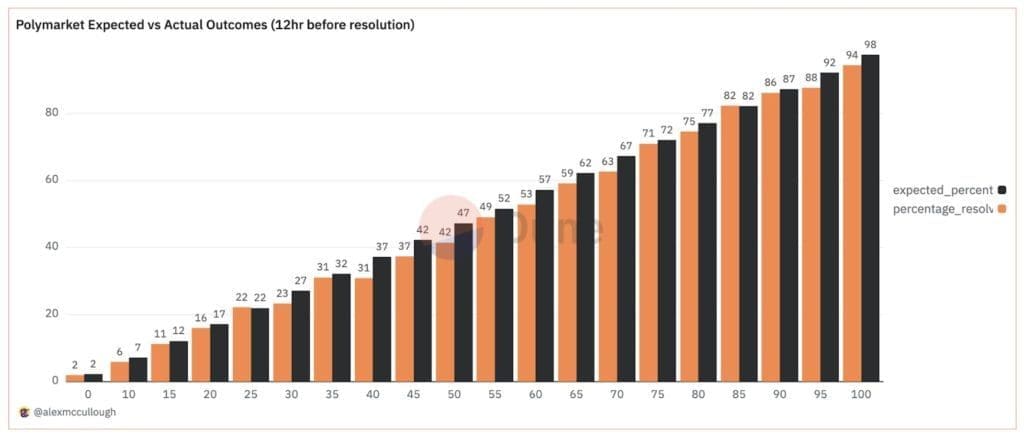

Polymarket has adopted this top-line figure for its ads promoting its 94% accuracy rate. However, those ads ignore McCullough’s most interesting finding: markets resolve at roughly the rate at which contracts are priced.

Polymarket accuracy data: Early surprises and new discoveries

McCullough had been a crypto and prediction market trader since 2016, but Polymarket was the first platform he used with many markets and enough liquidity to make trades. The wealth of publicly available data gave McCullough his first chance to study prediction market accuracy.

“I was expecting Polymarket to be less accurate than what I found,” McCullough said. “I was expecting in that zero to 5% bucket that basically none of them would resolve to Yes.”

McCullough found that Polymarket’s markets resolved at roughly the rate they were priced at 12 hours before resolution. For example, contracts priced at 67% resolved about 63% of the time.

McCullough suspects two factors are creating the small difference between the expected and actual resolution rates:

- Momentum trading: Traders may chase a contract’s recent directional move rather than its fundamental probability.

- Liquidity gaps: Polymarket’s earlier markets lacked much of the liquidity found on the platform today.

McCullough found an “underdog bias” which made longshot prices more expensive than their fair value. ”There’s just basically a lot of people who like to gamble on long odds,” he said.

A 2025 study of commercial prediction market Kalshi revealed similar findings. Economists at University College Dublin observed over 300,000 contracts and found the same pattern as McCullough did at Polymarket. The Dublin researchers also found evidence of favorite-longshot bias. Contracts with low prices resolved less often than expected, and contracts with high prices resolved more often than expected.

Prediction markets approach accurate prices, but there are small skewing effects caused by trader behavior as prices get closer to extreme values.

Sports markets are less accurate so far

Some of Polymarket’s most popular markets now include those on sports outcomes, which the platform only launched in 2024.

Because those markets offer fewer extreme outcomes, McCullough found their accuracy, based on his original methodology, was only about 66% the day before a game.

Short‑dated sports contracts, he notes, lack the numerous and obvious “No” bets that can pad accuracy in years‑long election markets with many contracts. Examples include Elizabeth Warren to be the 2024 Democratic presidential nominee, someone who was not in the running during the campaign but had odds available anyway.

As Polymarket works its way back into the American market, its 2025 sports season and the 2026 midterms could offer a wealth of markets to study.