The largest prediction market by trade volume is returning to the United States after a three-and-a-half year hiatus. Crypto prediction market platform Polymarket acquired a CFTC-licensed platform, QCEX, and its clearinghouse for $112 million.

The acquisition will give Polymarket a way to re-enter the U.S. market as a regulated derivatives exchange. QCEX just gained CFTC approval on July 9. In a press release, Polymarket CEO Shayne Coplan said:

“Demand is greater than ever — not just in user growth and trading volume, but in how mainstream audiences are turning to Polymarket to separate signal from noise, bias and speculation. Now, with the acquisition of QCEX, we are laying the foundation to bring Polymarket home — re-entering the US as a fully regulated and compliant platform that will allow Americans to trade their opinions.”

Polymarket exited the U.S. market in 2022 after paying a $1.4 million fine to settle accusations of failing to register with the Commodity Futures Trading Commission (CFTC). The company’s upcoming reentry to the United States comes on the heels of a favorable week for the prediction market industry.

Relaxed regulations, greater growth

Last week, the Department of Justice announced that it was ending two investigations into Polymarket related to U.S. customers illegally accessing the platform with VPNs. Additionally, PredictIt reached a settlement with the CFTC that allowed the academic prediction market platform to offer higher position limits and eliminate its trader limits in its political markets.

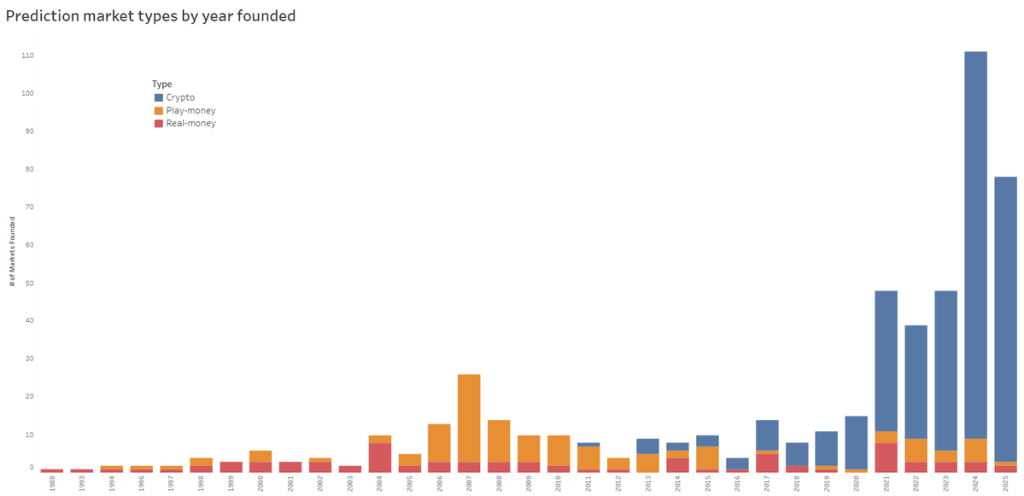

The next wave of prediction market industry expansion could come from the crypto regulation President Trump signed into law. Regulated stablecoins and crypto platforms will create opportunities for some of the many crypto prediction market platforms. Most new prediction market companies are started in the crypto industry, so the future regulated prediction markets is tied to U.S. crypto regulation. A chart recently shared on X shows the explosive growth of crypto prediction markets over time.

One of the remaining unresolved questions for prediction markets is whether sports event contracts will remain fair game for regulated platforms.

Maryland and the Third Circuit

Kalshi is still waiting for a ruling in its case against Maryland over the state’s cease and desist letter ordering sports contracts out of its state. Maryland, like almost a dozen other states, has argued that sports contracts are functionally the same as sports betting and should be regulated by states. Kalshi has countered that as a federally regulated derivatives exchange, gambling law and regulation have nothing to do with its operations.

Maryland is the latest battleground in District Court. That case’s judge ordered supplemental briefing, which invited amicus briefs from problem gambling and gaming industry organizations. The best arguments against Kalshi have been marshaled and weighed, so Maryland is a crucial crossroads for the prediction market and gaming industries.

Kalshi also has a case in the Third Circuit Court of Appeals, where a definitive ruling could potentially put an end to sports contracts’ legality. Regardless of what unfolds in the current court cases, the prediction market industry will have to be ready to adjust to CFTC regulations with changing political administrations.

Unless Congress offers definitive legislation or legal clarity on sports contracts, the prediction market industry may find itself having to continue shifting with the whims of the next CFTC Chair (after Brian Quintenz) or subsequent administrations. But this one, for the time being, remains agreeable to the continued expansion of future event contracts at Designated Contract Markets (DCMs) like Kalshi.